FEDERAL PAYROLL TAX CHANGES

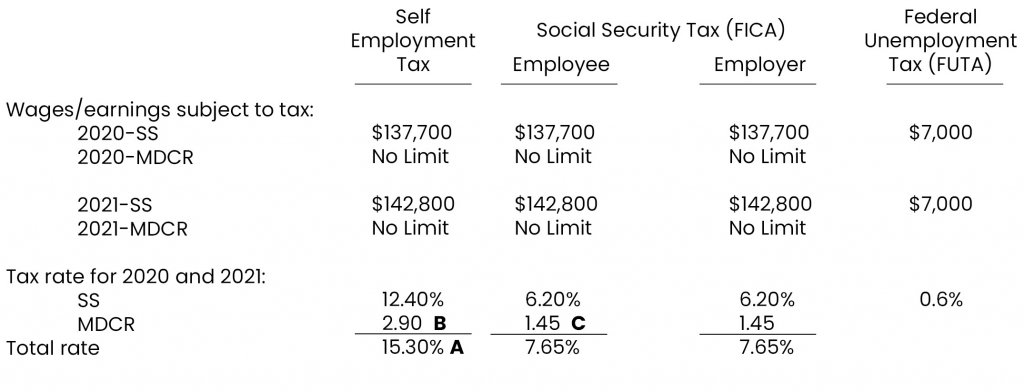

The FICA tax calculation is comprised of two components: Social Security (SS) and Medicare (MDCR). The federal unemployment tax wage base will remain the same for 2021. The taxable wage base and tax rates for calendar years 2020 and 2021 are summarized as follows:

A A deduction is allowed for one-half of the self-employment tax paid.

B On self-employment income over $200,000 ($250,000 for married filing jointly; $125,000 for married filing separately) an additional 0.9% Medicare tax applies. Therefore, the total self-employment tax rate for income over the applicable threshold will be 3.8%.

C Once an employer has paid an employee $200,000 in compensation subject to FICA taxes, an additional 0.9% Medicare tax must be withheld on all FICA compensation paid to that employee during the remainder of the year.

MICHIGAN PAYROLL TAX ITEMS

The taxable wage base for Michigan Unemployment Tax is $9,000 for contributing employers that are not delinquent on Michigan unemployment contributions, penalties, or interest. The Michigan unemployment tax rate is computed for each employer based on their unemployment experience.

The Michigan income tax withholding rate for 2021 is 4.25%.

MILEAGE RATE

Effective January 1, 2021, the standard mileage rate for business purposes is 56 cents per mile.

NEW FROM 1099-NEC

There is a new form 1099-NEC to report nonemployee compensation paid in 2020. The 2020 Form 1099-NEC is due February 1, 2021. A copy of the 2020 Form 1099-NEC must be filed with the city reported as the payee’s address if that city imposes a city income tax. Michigan cities that impose city income tax are: Albion, Battle Creek, Benton Harbor, Big Rapids, Detroit, East Lansing, Flint, Grand Rapids, Grayling, Hamtramck, Highland Park, Hudson, Ionia, Jackson, Lansing, Lapeer, Muskegon, Muskegon Heights, Pontiac, Port Huron, Portland, Saginaw, Springfield, and Walker.

HEALTH CARE REPORTING

Providers of minimum essential health insurance coverage (employers) will be required to file information returns (Forms 1094/1095) with the IRS for the 2020 calendar year no later than February 28, 2021, or March 31, 2021 (if filed electronically). The due date for providing Form 1095-B to the individual recipient is March 2, 2021.

MICHIGAN MINIMUM WAGE INCREASE

The current federal minimum wage is $7.25 per hour; however, some states have a higher minimum wage rate. When the state minimum wage rate is higher than the federal rate, workers must be paid the higher amount. Michigan’s 2020 minimum wage rate for non-tipped employees was $9.65 and did not increase on January 1, 2021. The minimum wage for tipped employees will remain at $3.67 per hour for 2021.

Michigan’s minimum wage is scheduled to continue increasing according to the schedule found on the State of Michigan website.

COVID-19 TAX CREDITS

Coronavirus (COVID-19) related employment tax credits and other tax relief is available for those impacted by the COVID-19 disaster.

- Families First Coronavirus Response Act (FFCRA) – Provides certain employers with tax credits that reimburse them for the cost of providing paid sick and family leave wages to their employees for leave related to COVID-19.

- Coronavirus Aid, Relief, and Economic Security Act (CARES Act) – Provides eligible employers with an employee retention tax credit if they keep employees on their payroll despite economic hardships related to COVID-19.

If you have additional questions or concerns regarding any of these issues, feel free to contact AHP during normal business hours. AHP provides a full range of payroll processing services including: customized processing and reporting, direct deposit, WEB Employee, ACA compliance reporting, preparation of monthly, quarterly, and annual tax returns, including W-2’s and various other payroll related services. If you are interested in cost savings, continuity in service, and security, feel free to contact AHP to inquire how we can give you that peace of mind and professional service tailored to suit your needs.