The new current expected credit loss (CECL) model for measuring credit losses has had a significant impact on the financial institution industry and those that have loans receivable; however, its reach extends to other industries and beyond just loans. With most entities being required to have this standard adopted in their December 31, 2023 financial statements, the time to implement is now.

What is CECL?

Accounting Standards Update (ASU) No. 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, as amended, was issued to replace the incurred loss model for measurement of credit loss on financial instruments with an expected loss model, which is referred to as the current expected credit loss (CECL) model.

- Under CECL, credit losses are recognized earlier.

Instead of recording credit losses as incurred, lifetime credit losses are recorded upon initial recording of the financial instrument.

- CECL is forward looking.

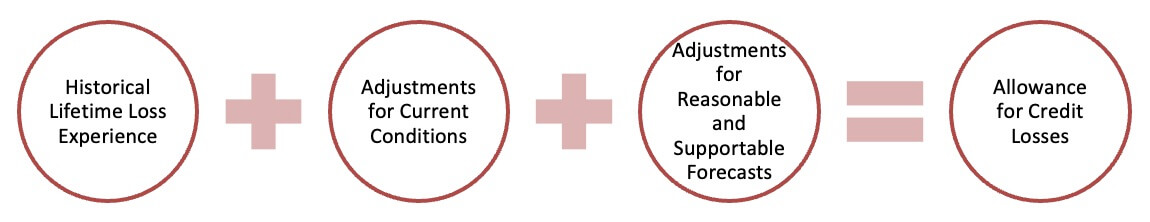

Estimated credit losses will be based on relevant information about historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported amounts.

What financial instruments are covered under CECL?

Financial instruments measured at amortized cost are covered under CECL.

Covered:

- Financing receivables (i.e., loans)

- Trade accounts receivables

- Notes receivables

- Held-to-maturity debt securities

- Off-balance sheet credit exposures (i.e., loan commitments and lines of credit)

- Reinsurance recoverables

- Receivables related to repurchase and security lending agreements

- Net investment in leases recognized by lessors (sales-type and direct financing leases)

- Certain financial guarantees

Excluded:

- Financial assets measured at fair value through net income

- Loans held for sale

- Not-for-profit pledges receivable (i.e., promises to give)

- Derivatives

- Available-for-sale debt securities (but accounting has changed with ASU 2016-13)

- Defined contribution benefit plan employee loans

- Insurance policy loan receivable

- Related-party loans and receivables between entities under common control

- Income tax receivable

- Receivables arising from operating leases

When is CECL effective?

SEC Filers – Years beginning after December 15, 2019, including quarterly reporting

All Others – Years beginning after December 15, 2022, including quarterly reporting

That means January 1, 2023 for 12/31 fiscal year ends.

What is the impact of CECL?

- Credit losses are recognized earlier

- May require more data collection to incorporate into model

- May result in larger allowance for credit losses than previous model

- Increased volatility in earnings

- New financial statement disclosures

How do I implement CECL?

- Pool assets

- Determine the assets amortized cost at date of adoption

- Consider available relevant information

- Apply estimation method

– Reflect the risk of loss, even if remote

– Reflect losses over an asset’s contractual life - Record the allowance for credit loss (ACL)

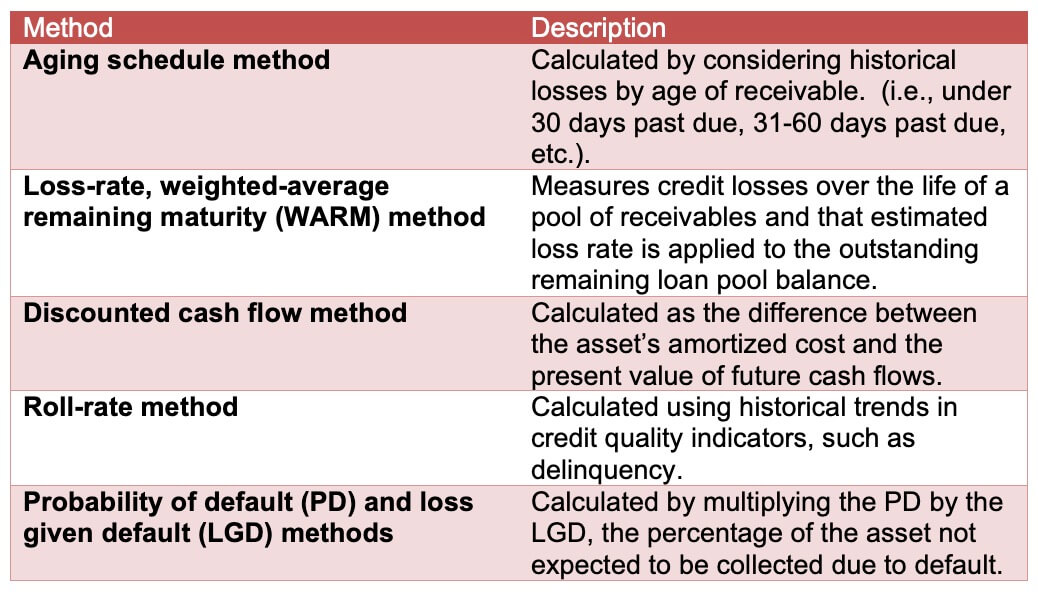

Common Estimation Methods of CECL Allowance for Credit Losses

Recording the Allowance for Credit Losses

- At the date of adoption there will be a cumulative-effect adjustment posted to retained earnings to establish the amount of ACL required under CECL.

- Subsequent increases or decreases will be recorded as a debit (increase) or credit (decrease) to credit loss expense.

- Write-offs and recoveries under the new standard are recorded similar to prior GAAP.

- An allowance for off-balance sheet credit exposures will be recorded as a liability.

Example Journal Entries:

- Recording financial assets carried at amortized cost at standard adoption (cumulative-effect adjustment at January 1, 2023 for 12/31 fiscal year ends) *

- Debit: Retained earnings

- Debit: Deferred income taxes (for tax effect)

- Credit: Allowance for credit losses

* Entry shown is to record an increase in the ACL upon adoption (Day 1). A Day 1 decrease in the ACL would be recorded as a debit to the ACL and credit to retained earnings and deferred income taxes.

- Recording a subsequent increase in expected credit losses

- Debit: Credit loss expense

- Credit: Allowance for credit losses

- Credit: Allowance for credit losses

- Debit: Credit loss expense

- Recording a subsequent decrease in expected credit losses

- Debit: Allowance for credit losses

- Credit: Credit loss expense

- Debit: Allowance for credit losses

- Recording write-offs

- Debit: Allowance for credit losses

- Credit: Asset

- Debit: Allowance for credit losses

- Recording recoveries

- Debit: Cash

- Credit: Credit losses or allowance

- Debit: Cash

- Recording allowance of off-balance sheet credit exposures at date of adoption

- Debit: Retained earnings

- Debit: Deferred income taxes (for tax effect)

- Credit: Liability for losses of off-balance sheet credit exposures

- Credit: Liability for losses of off-balance sheet credit exposures

The time to implement is now and we are here to help!

Contact Rebekah Kilpatrick, CPA, CRCM at 989-497-5300 or rebekah.kilpatrick@ahpplc.com

or a member of your AHP engagement team today

to let us help you with your CECL questions.

Full Article: Implementing CECL, It’s Not Just for Financial Institutions