Be sure to check out the Winter 2026 edition of Community Banking Advisor. The newsletter is a wealth of information.

Winter 2026 Community Banking Advisory

Be sure to check out the Winter 2026 edition of Community Banking Advisor. The newsletter is a wealth of information.

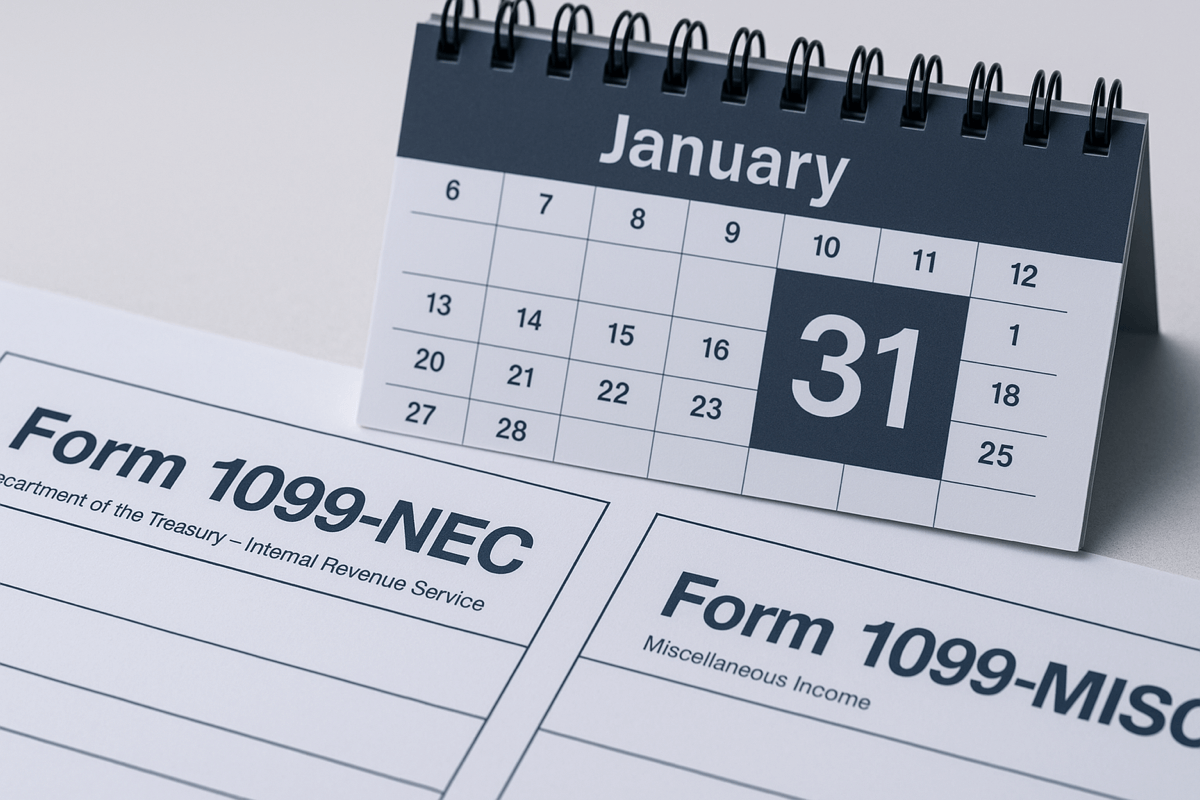

Preparing your Form 1099 filings doesn’t have to be complicated. By reviewing vendor payments and confirming W-9 information now, you can ensure compliance and avoid last-minute stress. AHP is available to assist you in determining which vendors require a 1099 and to support you throughout the filing process.

Most small to midsize businesses today are constantly under pressure to upgrade their information technology (IT). Whether it’s new software, a better way to use the cloud or a means to strengthen cybersecurity, there’s always something to spend more money on.

It’s every business owner’s nightmare. You wake up in the morning, or perhaps in the middle of the night, and see that dreaded message: “We’re down.” It could be your website, e-commerce platform or some other mission-critical information technology (IT) system. All you know is it’s down and your company is losing money by the hour.

Employee health coverage is a significant part of many companies’ benefits packages. However, the administrative responsibilities that accompany offering health insurance can be complex. One crucial aspect is understanding the reporting requirements of federal agencies such as the IRS. Does your business have to comply, and if so, what must you do? Here are some answers to questions you may have.

In June, the IRS and the Department of the Treasury issued guidance to close potential loopholes in the tax code for partnership entities. Utilizing funding from the Inflation Reduction Act, one of the IRS’ focal points is partnership basis and how shifting it between related parties (either partnerships or partners) is generating potentially unfair tax benefits for taxpayers.

For many business owners, choosing a successor is the most difficult task related to succession planning. Owners of family-owned businesses, who may have multiple children or other relatives to consider, particularly tend to struggle with this tough choice.

Divorce entails difficult personal issues, and taxes are probably the farthest thing from your mind. However, several tax concerns may need to be addressed to ensure that taxes are kept to a minimum and that important tax-related decisions are properly made. Here are six issues to be aware of if you’re in the process of getting a divorce.

Are you in the early stages of divorce? In addition to the tough personal issues that you’re dealing with, several tax concerns need to be addressed to ensure that taxes are kept to a minimum and that important tax-related decisions are properly made. Here are five issues to consider if you’re in the process of getting a divorce.

Taking care of an elderly parent or grandparent may provide more than just personal satisfaction. You could also be eligible for tax breaks. Here’s a rundown of some of them.