Now that fall is officially here, it’s a good time to start taking steps that may lower your tax bill for this year and next.

Year-end tax planning ideas for individuals

Now that fall is officially here, it’s a good time to start taking steps that may lower your tax bill for this year and next.

Every business owner should establish strong policies, procedures and internal controls to prevent fraud. But don’t stop there. Also be prepared to act if indications arise that, despite your best efforts, wrongdoing has taken place at your company.

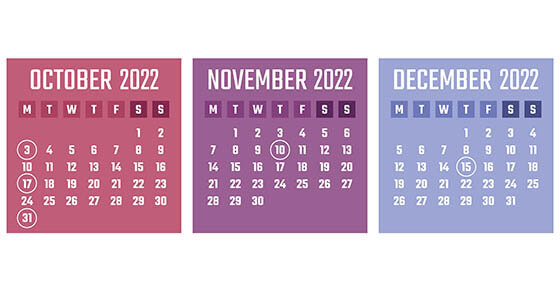

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

“We love our customers!” Many businesses proclaim this at the bottom of their invoices, in their marketing materials and even on the very walls of their physical locations.

In its latest report, the National Association of Realtors (NAR) announced that July 2022 existing home sales were down but prices were up nationwide, compared with last year. “The ongoing sales decline reflects the impact of the mortgage rate peak of 6% in early June,” said NAR Chief Economist Lawrence Yun. However, he added that “home sales may soon stabilize since mortgage rates have fallen to near 5%, thereby giving an additional boost of purchasing power to home buyers.”

There are two special taxes that may have a significant effect on the tax bills of high-income folks: the 3.8% net investment income tax and a 0.9% additional Medicare tax on wage and self-employment income. Here are the basic rules.

Mention the word “audit” to a business owner and you’ll probably get an anxious look. But not all audits are of the tax, financial statement or retirement plan variety. You can audit many areas of your company to help you better manage those functions. Take your brand, for example.

You may have heard that the Inflation Reduction Act (IRA) was signed into law recently. While experts have varying opinions about whether it will reduce inflation in the near future, it contains, extends and modifies many climate and energy-related tax credits that may be of interest to individuals.

Do you own a successful small business with no employees and want to set up a retirement plan? Or do you want to upgrade from a SIMPLE IRA or Simplified Employee Pension (SEP) plan? Consider a solo 401(k) if you have healthy self-employment income and want to contribute substantial amounts to a retirement nest egg.

Many offices, plants and other business facilities are once again filled with real, live people. And those hard-working employees need somewhere to park. If your company provides parking as a fringe benefit — either on or near your premises or at a location from which employees commute — the IRS may take an interest in the arrangement.