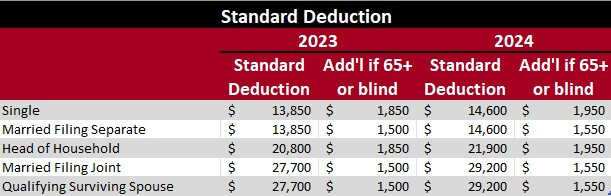

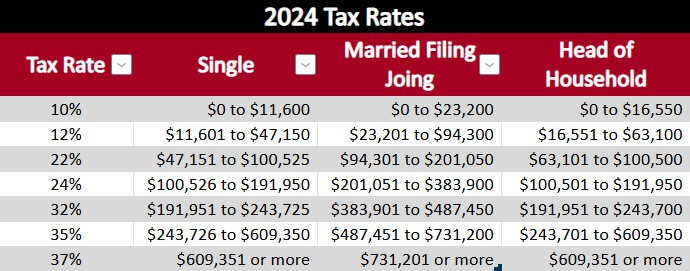

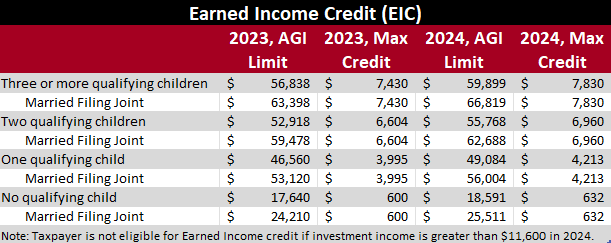

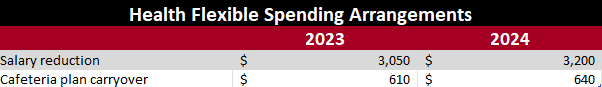

Revenue procedure announced more than 60 provisions being updated for annual inflation adjustments. A few key areas not affected are:

- The personal exemption remains at $0 for 2024.

- There is no limitation on itemized deductions.

- The Lifetime Learning Credit continues to be phased out for taxpayers with modified adjusted gross income over $80,000 ($160,000 for married filing joint).

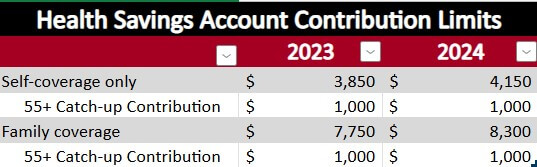

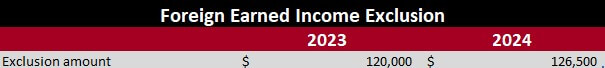

A few key areas that were affected are highlighted in the tables below: