Dear Client,

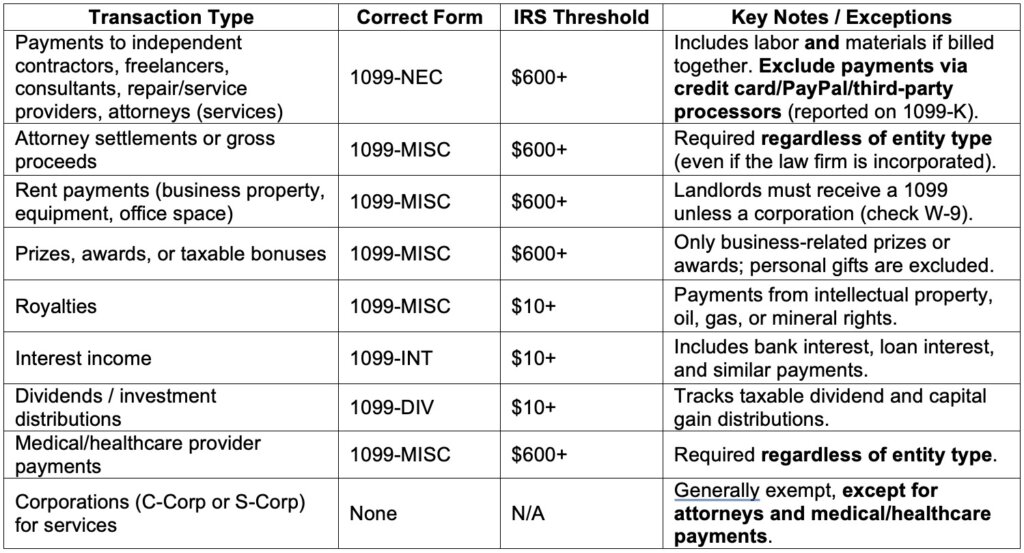

As we approach year-end, it is time to begin preparing your annual Form 1099 filings. Businesses are required to issue Form 1099 to any non-employee who performed services for your company and was paid $600 or more during the calendar year. This threshold includes both labor and materials when paid together on the same invoice.

Please note: If you paid a vendor using a credit card, debit card, PayPal, Venmo, or any similar third-party payment processor, you are not responsible for issuing a 1099. These payments will generally be reported by the payment processor on Form 1099-K.

Information Needed

Please review your records and identify any vendors who may require a 1099. For each potential recipient, confirm that you have:

- Legal name (as registered with the IRS)

- Current mailing address

- Social Security Number or Federal Employer Identification Number (FEIN)

If you are missing information, please send the vendor a Form W-9 and obtain a completed copy.

Guidance by Entity Type

When reviewing the W-9, the vendor’s tax classification determines whether a 1099 is required:

- Sole Proprietor / Single-Member LLC (disregarded)

Issue a 1099 using the individual’s name and SSN, even if the vendor operates under a business name. - Partnership or LLC taxed as a partnership

Issue a 1099 using the partnership’s name and FEIN. - LLC taxed as a corporation or C-Corporation / S-Corporation

No 1099 is required except for:- Attorneys (always require a 1099)

- Medical or health care providers

- Attorneys (any entity type)

A 1099 is required regardless of the entity classification.

Deadline Reminder

The IRS requires that 1099-NEC forms be provided to subcontractors no later than January 31, 2026. To ensure timely preparation, please submit your complete vendor list and W-9 information to AHP as soon as possible after January 1, 2026.

To make this process easier, we have included a vendor information form for you to complete and submit.

If you are unsure which vendors require a 1099, or if you need assistance calculating totals for each vendor, please contact us. We are happy to help review your records and ensure your filings are accurate and complete. If AHP already handles all of your bookkeeping we can review those records already on file to ensure all of the correct recipients and amounts are included.

Sincerely,

Andrews Hooper Pavlik PLC