https://vimeo.com/1170726062

GASB 104 Webinar – Disclosure of Certain Capital Assets

https://vimeo.com/1170726062

https://vimeo.com/1167765294

While many taxpayers are still gathering their documents to file their 2025 taxes, we are looking ahead to changes coming in 2026 and 2027. Knowing what’s coming can help you avoid surprises and take advantage of new opportunities.

Does your family business keep its strategic decisions within the family? It’s common for family businesses to assign relatives to positions of authority and require other employees to defer to them. But “common” doesn’t necessarily mean “good.”

If you own a business or are self-employed and haven’t already set up a tax-advantaged retirement plan, consider establishing one before you file your 2025 tax return. If you choose a Simplified Employee Pension (SEP), you’ll be able make deductible 2025 contributions to it, saving you taxes.

Payroll fraud schemes can be costly — and for small businesses, devastating. The Association of Certified Fraud Examiners (ACFE) has found that the median loss from payroll fraud schemes is $50,000.

Many owners assume that since their business is successful, they will automatically get the highest price once they decide to sell, but that is not always the case.

Charitable giving has long been a cornerstone of tax planning. Before the 2025 year closes, we wanted to make you aware of several significant changes to the charitable giving tax rules that will take effect in 2026, reshaping the landscape for donors. Understanding these changes is crucial for maximizing the impact of your philanthropy and your tax savings.

Many entities often struggle with the complexity of the current expected credit losses (CECL) model, especially the requirement to forecast future economic conditions when estimating credit losses on accounts receivable. ASU 2025-05, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses for Accounts Receivable and Contract Assets, issued on July 30, 2025, brings some relief with simpler options tailored to the short-term nature of most accounts receivable.

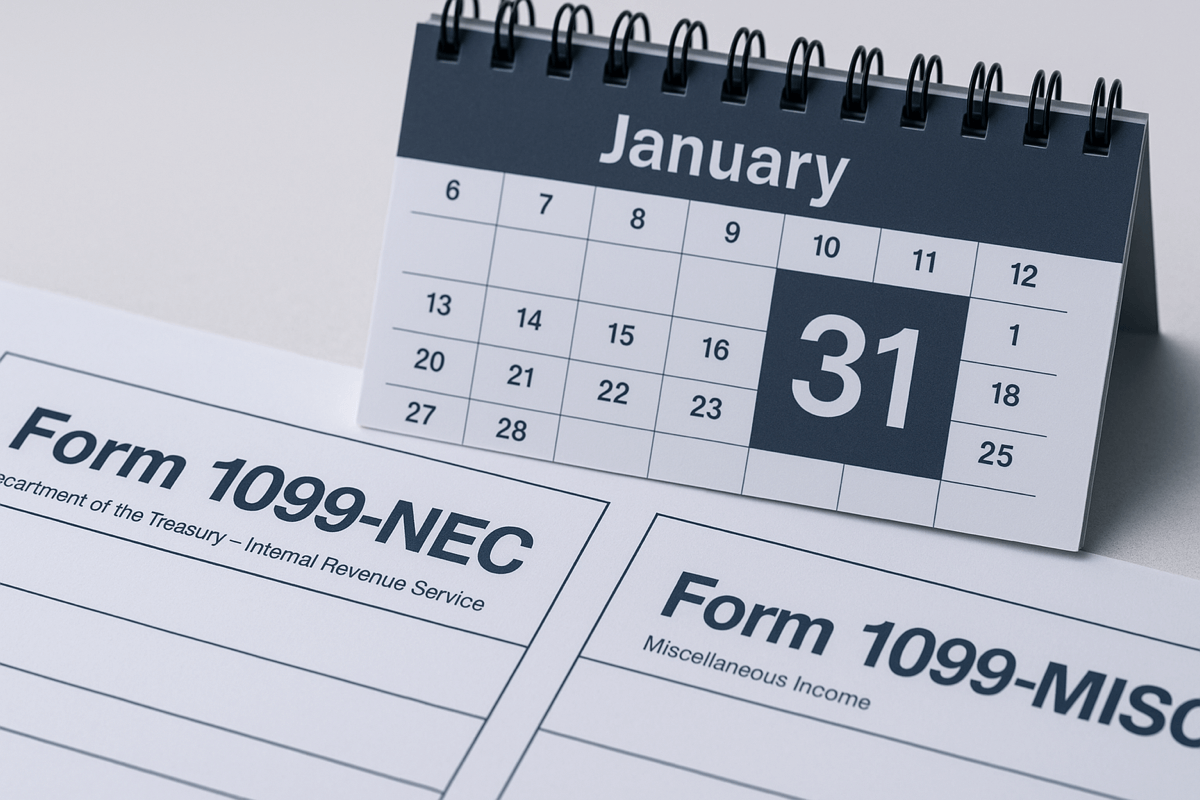

Preparing your Form 1099 filings doesn’t have to be complicated. By reviewing vendor payments and confirming W-9 information now, you can ensure compliance and avoid last-minute stress. AHP is available to assist you in determining which vendors require a 1099 and to support you throughout the filing process.